Display related transactions for an order

Check the related transactions for an order

To display the transactions for an order, do these steps.

-

From an Orders list, click on the ID of the order or the CUSTOMER name.

-

The Order Summary displays the order details. At the bottom of the screen, Related Transactions displays the authorisations and payments that have been processed for the card.

Display the transactions related to an order

-

To display processing details for a payment, click on the Transaction Unique ID. The Transaction Details pop-up will open. It includes the Result and the Card Details.

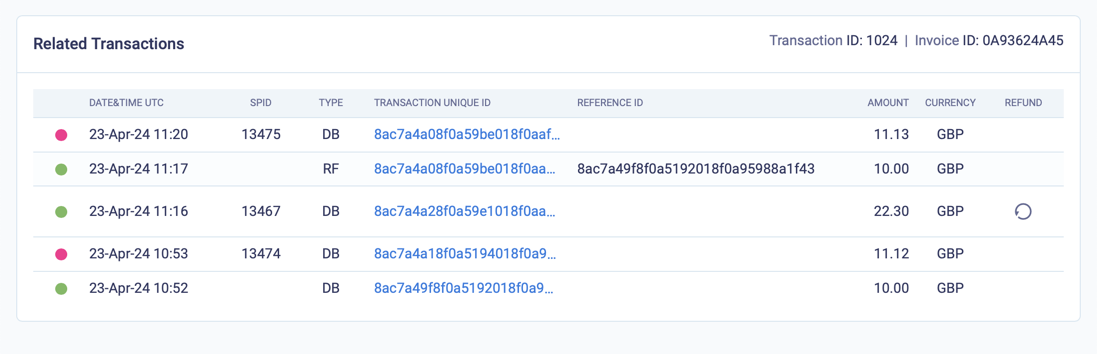

Transactions list

The Transactions list contains the following fields.

| Field | Description |

|---|---|

| Status indicator | A green dot represents an approved transaction, and a red dot represents a declined transaction |

| Date/Time UTC | The date and time that the transaction was processed in UTC time |

| SPID | The system's unique identifier of a scheduled payment for an active instalment, subscription, or metered order. |

| Type | See Transaction types |

| Transaction unique ID | The Gateway ID for the transaction. Click to display the transaction details. |

| Reference ID | The Gateway ID of a previous related transaction. For example, if you refund a DB (debit) transaction, then the Reference ID of the refund is the Gateway ID of the DB transaction |

| Amount | The amount of the transaction. The amount will be debited from or credited to the merchant account, depending on the transaction type. |

| Currency | The currency of the transaction. |

| Refund | If it is possible to refund a DB or CP transaction, BillPro displays the circular arrow Refund button next to it. Click this button to make a refund. When the transaction has been fully refunded, BillPro will hide the Refund button. |

Approved transactions

If the transaction is approved, the gateway's Result Code will have a value of 000.000.000. (In a test environment, it may have other values too). The Scheme Response Code will have a value of 0. If it is a recurring payment, the Merchant Advice Code or Visa Category Code will also have a value of 0. If there are non-zero values, the transaction was declined.

Details of a transaction approved with CardCorp

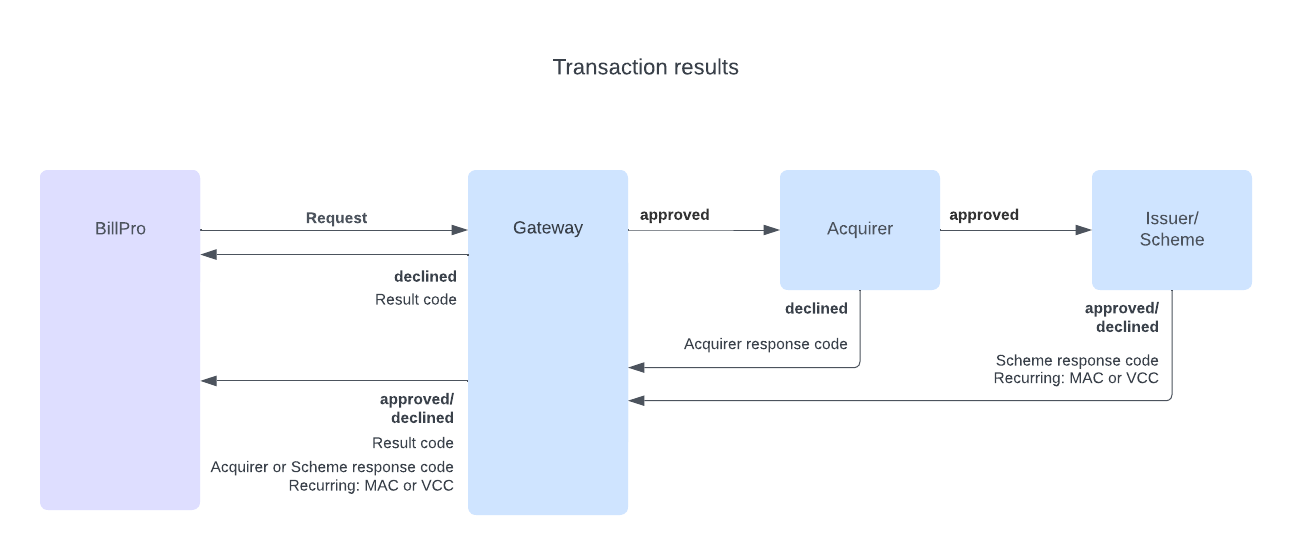

Transaction approval flow

The transaction approval process goes through the entities in this order.

- Gateway

- Acquirer

- Card Scheme

In the transaction response, the gateway returns one or more codes to the merchant, depending on which stage in the approval process a transaction reaches.

Transaction response workflow

Updated 4 months ago